How We See It!

Interest Rates as a Causation

of Rate of Inflation

Home Owners navigate everything that governments and central bankers throw at them. Generations of Home Owners have taught the generations of Owners that followed, through a process we call HomeOwnership Infrastructure Evolution, everything Owners do to counteract the negative impact governments and central bankers bring to their lives. Through the evolution of Owners behaviours and the result those behaviours bring to the greater economy, it is through this lens how we see almost everything.

When you accept the prudence and insights Home Owners can provide in their unending quest to protect their family and ownership of the family home you can gain a better understanding of how you should view other impacts to their lives. Inflation dominates our lives through the same compounding effect that allows Home Owner to live their lives Income Net-Negative for housing costs.

In the study of the home trading market we never focus on micro data but instead zoom out to a larger macro perspective to Time the Market. What if we simply looked at inflation with the same lens that has lead generation after generation of Home Owners to choose 5 year term mortgages? What if Owner Behaviour interacting with the economy is recorded in inflation itself? What if the belief that central bankers and governments hold that to reduce inflation you need to increase interest rates in the belief that the resulting stifled demand will reduce inflation? What over a period of decades just the opposite happened? What if declining interest rates actually reduced inflation? What if Owners Behaviour has evolved since the 1991 mandate to target 2% average annual inflation commenced into behaviour clearly recorded when zooming out to that macro perspective.

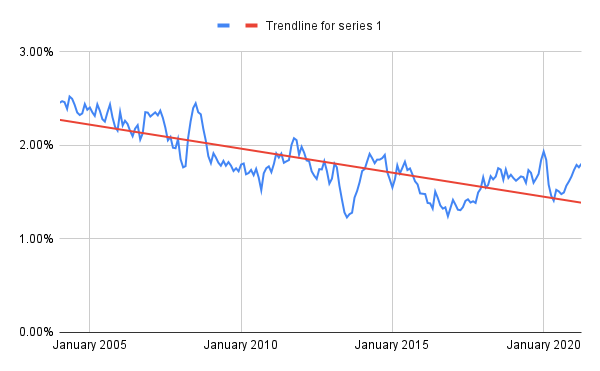

Above you see how we see it! You can clearly see how from 2004 through 2021 inflation declined continually ending well below the original targeted goal. How we see it is important because we monitor inflation from a 5 year compounding annual perspective, just like Canadian Home Owners have reduced their risk when mortgaging for generations by taking the 5 year guaranteed term.

In the same way that the home trading market turns months before conventional statistics record that it is turned so do we naturally expect to see a 2 to 4 year delay in inflation adjusting to a decrease in interest rates. The inflation we expected to begin seeing after 2000s reduction in interest rates showed up less than 4 years later in the evolved behaviour of Home Owners in their consumption decisions.

In the spring of 2000 a well negotiated 5 year fixed rated mortgage was during the year on average obtainable at 7.0%.

(Now you need to trust us as we own the only weekly recording of 1987-current day obtainable mortgage rates.)

Interest rates did rise and fall slightly on their downward path to 1.99% before moving upward in early 2022, but the resistance Home Owners caused in the economy when rates were increased or even when held unchanged could not be withstood by central bankers in their attempts to produce economic growth.

We are home trading market analysts and homeownership experts, nothing more and nothing less. We will leave the greater discussion of inflation and rates to other while we concentrate on the view we obtain when looking at it like owners look.

We have a 22 year study on this page that suggests decreasing interest rates causes decreasing inflation.

The universal belief by economists that increasing interest rates will decrease inflation should at least be challenged is how we see it!

How can you reduce interest rates for 22 years and produce 18 years of declining inflation only to cause great financial hardship on those least able to withstand it by claiming the last 18 years did not exist?

Why has no one challenged this belief?

What data and analysis from history are being cited as being more reliable than what we produced here on this page?

When you accept the prudence and insights Home Owners can provide in their unending quest to protect their family and ownership of the family home you can gain a better understanding of how you should view other impacts to their lives. Inflation dominates our lives through the same compounding effect that allows Home Owner to live their lives Income Net-Negative for housing costs.

In the study of the home trading market we never focus on micro data but instead zoom out to a larger macro perspective to Time the Market. What if we simply looked at inflation with the same lens that has lead generation after generation of Home Owners to choose 5 year term mortgages? What if Owner Behaviour interacting with the economy is recorded in inflation itself? What if the belief that central bankers and governments hold that to reduce inflation you need to increase interest rates in the belief that the resulting stifled demand will reduce inflation? What over a period of decades just the opposite happened? What if declining interest rates actually reduced inflation? What if Owners Behaviour has evolved since the 1991 mandate to target 2% average annual inflation commenced into behaviour clearly recorded when zooming out to that macro perspective.

Above you see how we see it! You can clearly see how from 2004 through 2021 inflation declined continually ending well below the original targeted goal. How we see it is important because we monitor inflation from a 5 year compounding annual perspective, just like Canadian Home Owners have reduced their risk when mortgaging for generations by taking the 5 year guaranteed term.

In the same way that the home trading market turns months before conventional statistics record that it is turned so do we naturally expect to see a 2 to 4 year delay in inflation adjusting to a decrease in interest rates. The inflation we expected to begin seeing after 2000s reduction in interest rates showed up less than 4 years later in the evolved behaviour of Home Owners in their consumption decisions.

In the spring of 2000 a well negotiated 5 year fixed rated mortgage was during the year on average obtainable at 7.0%.

(Now you need to trust us as we own the only weekly recording of 1987-current day obtainable mortgage rates.)

Interest rates did rise and fall slightly on their downward path to 1.99% before moving upward in early 2022, but the resistance Home Owners caused in the economy when rates were increased or even when held unchanged could not be withstood by central bankers in their attempts to produce economic growth.

We are home trading market analysts and homeownership experts, nothing more and nothing less. We will leave the greater discussion of inflation and rates to other while we concentrate on the view we obtain when looking at it like owners look.

We have a 22 year study on this page that suggests decreasing interest rates causes decreasing inflation.

The universal belief by economists that increasing interest rates will decrease inflation should at least be challenged is how we see it!

How can you reduce interest rates for 22 years and produce 18 years of declining inflation only to cause great financial hardship on those least able to withstand it by claiming the last 18 years did not exist?

Why has no one challenged this belief?

What data and analysis from history are being cited as being more reliable than what we produced here on this page?