Research

Our unique perspective often affords us an opportunity to bring housing market insight that would not normally be possible without our unique position being held. Here you will find our latest research into areas of the housing market that only our unique perspective could afford.

The following most recent release went live at 10:09am Friday May 13th, 2016. Any edits after that time will be noted here in red. Always refresh your browser to get our latest changes.

Vancouver's Currency Exchange Ponzi Scheme against Canada's Housing Bubble

“A Currency Exchange Ponzi scheme is a fraudulent investment strategy where the participants in the scheme withdraw capital through a trade of real estate being recorded where new participants pay increasingly higher and higher prices based on the assumption that on the next price being paid it will be high enough to allow that new participant in the scheme to withdraw the capital they themselves invested, rather than capital being withdrawn through normal house price growth. A Currency Exchange Ponzi scheme can be used for a variety of illegal purposes such as to launder funds or to acquire capital through debt secured on artificially inflated selling prices.”

Canada's Housing Bubble:

Naysayers may argue but expert analysis supports all housing markets in Canada form housing bubbles naturally as an expected consequence of how the home selling infrastructure was built. The size of Canada's Housing Bubble is measured through house price growth and historically is always measured through changes to Average Selling Price. In Canada for the month of March the Average Selling Price in Canada was reported to be about $508,000 for a staggering year over year increase of 15.7%.

The Set Up:

The 365 Detached homes that Sold in March 2016 in Vancouver West and West Vancouver, the two districts this report is focused on represented only 0.7% of the total homes sold that month nationally but those 365 homes were responsible for a staggering 5.0% of the National Average Selling Price that was reported that month. To put this in perspective if in April the 50,000 homes that sold in March resold at the exact same price but those 365 homes simply did not resell headlines across Canada would read a 5% house price correction was recorded in a single month for a new Canadian 30 day record price decline.

In all probability a headline like that could be the trigger that pops Canada's Housing Bubble.

The Premise:

Why does a criminal sell stolen goods for less than their real value? Why would an investor buy an asset knowing full well his odds of losing money are almost assured? What strategy could be employed to work to the advantage of the investor who has something to hide? Why would a successful and investment savvy multi-millionaire living in China choose to buy a real estate investment in Vancouver knowing his only chance to at least break-even would require the investment purchased to experience record setting gains in valuation or a loss would be incurred?

These were the questions we had to consider when any other explanation of Vancouver's house price gains could not be supported through housing market fundamentals.

The Facts:

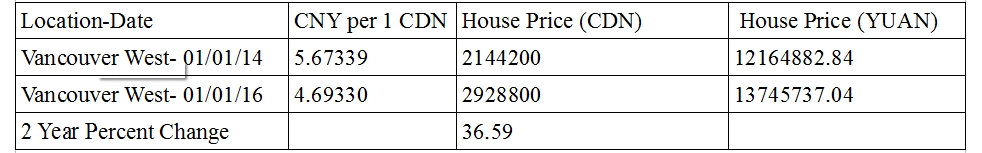

In order for a Chinese investor to have just broken even from purchasing a single detached home in Vancouver's housing market on January 2014 through to a January 2016 sale, a 35% house price gain was required to be recorded. In West Vancouver and Vancouver West prices rose almost that exact amount during that period.

The Conditions required to support a Ponzi Scheme in Canada's real estate market:

- enough inflow of capital from outside the market ( ie non-resident purchases) to support the scheme

- delinquency of FINTRAC filings on suspicious transactions or a FINTRAC bypass process

- the ability to Assign property contracts through a simple "paper flip"

- low trading costs

- low taxation environment on valuation gains

- lack of oversight on those facilitating the sales process or ability to bypass oversight altogether

- no legislation that precludes an unhindered exchange or limits to who can own

Vancouver offers all the required conditions that would make a real estate ponzi scheme possible and was only lacking willing participants to the scheme to set the wheels in motion. We now know that massive capital has flowed into Vancouver from China, FINTRAC filings have been delinquent or bypassed, property assignments were common, trading costs were low, taxation on home price gains was minimal and often bypassed and unreported, the RECBC was not effectively monitoring the real estate brokerage community while non-regulated “facilitator's” were going door to door unchecked, all this happening in a legislative environment that allows anyone around the world to own a home in BC and sell it as they choose with Canadian legal representation that is encumbered to remain silent.

The Math:

The math in a real estate ponzi scheme designed to launder foreign money is quite simple. Through cash purchases of real estate the successive price paid must change to offset currency exchange rates experienced and costs incurred by the previous owner while the property was held.

(costs incurred are currency exchange fees, legal costs, taxes, acquisition and divestiture costs, net property holding expense which increases the longer the hold lasts)

Naysayers may argue but expert analysis supports all housing markets in Canada form housing bubbles naturally as an expected consequence of how the home selling infrastructure was built. The size of Canada's Housing Bubble is measured through house price growth and historically is always measured through changes to Average Selling Price. In Canada for the month of March the Average Selling Price in Canada was reported to be about $508,000 for a staggering year over year increase of 15.7%.

The Set Up:

The 365 Detached homes that Sold in March 2016 in Vancouver West and West Vancouver, the two districts this report is focused on represented only 0.7% of the total homes sold that month nationally but those 365 homes were responsible for a staggering 5.0% of the National Average Selling Price that was reported that month. To put this in perspective if in April the 50,000 homes that sold in March resold at the exact same price but those 365 homes simply did not resell headlines across Canada would read a 5% house price correction was recorded in a single month for a new Canadian 30 day record price decline.

In all probability a headline like that could be the trigger that pops Canada's Housing Bubble.

The Premise:

Why does a criminal sell stolen goods for less than their real value? Why would an investor buy an asset knowing full well his odds of losing money are almost assured? What strategy could be employed to work to the advantage of the investor who has something to hide? Why would a successful and investment savvy multi-millionaire living in China choose to buy a real estate investment in Vancouver knowing his only chance to at least break-even would require the investment purchased to experience record setting gains in valuation or a loss would be incurred?

These were the questions we had to consider when any other explanation of Vancouver's house price gains could not be supported through housing market fundamentals.

The Facts:

In order for a Chinese investor to have just broken even from purchasing a single detached home in Vancouver's housing market on January 2014 through to a January 2016 sale, a 35% house price gain was required to be recorded. In West Vancouver and Vancouver West prices rose almost that exact amount during that period.

The Conditions required to support a Ponzi Scheme in Canada's real estate market:

- enough inflow of capital from outside the market ( ie non-resident purchases) to support the scheme

- delinquency of FINTRAC filings on suspicious transactions or a FINTRAC bypass process

- the ability to Assign property contracts through a simple "paper flip"

- low trading costs

- low taxation environment on valuation gains

- lack of oversight on those facilitating the sales process or ability to bypass oversight altogether

- no legislation that precludes an unhindered exchange or limits to who can own

Vancouver offers all the required conditions that would make a real estate ponzi scheme possible and was only lacking willing participants to the scheme to set the wheels in motion. We now know that massive capital has flowed into Vancouver from China, FINTRAC filings have been delinquent or bypassed, property assignments were common, trading costs were low, taxation on home price gains was minimal and often bypassed and unreported, the RECBC was not effectively monitoring the real estate brokerage community while non-regulated “facilitator's” were going door to door unchecked, all this happening in a legislative environment that allows anyone around the world to own a home in BC and sell it as they choose with Canadian legal representation that is encumbered to remain silent.

The Math:

The math in a real estate ponzi scheme designed to launder foreign money is quite simple. Through cash purchases of real estate the successive price paid must change to offset currency exchange rates experienced and costs incurred by the previous owner while the property was held.

(costs incurred are currency exchange fees, legal costs, taxes, acquisition and divestiture costs, net property holding expense which increases the longer the hold lasts)

The sample above shows how house price growth experienced in Vancouver West that would not be supported through any market fundamentals could rationally only be explained through capital flowing into Vancouver West from China, yet only created a “break-even” investment opportunity for the Chinese investor because somehow house prices rose 36.6%.

The Currency Exchange Ponzi Scheme Process:

A investor seeking to remove Chinese Yuan from China and have it converted into a foreign currency purchases a home in Vancouver. The investor once having the currency exchange authorized and completed for the purchase to take place then offers the same opportunity to another investor who is willing to offset any costs the original investor incurred through paying a high enough price for the same home that then allows the previous investor to “break-even”. This pattern is continued over and over again causing the selling price to raise higher and higher at no risk to the investor, while at the same time offering higher and higher amounts of currency to be exchanged on the rising home price being paid.

At no time is the price paid reflective of fundamental value of the real estate being traded but is being established for ulterior purposes that are not related to normal house price growth.

At some point in time the scheme ends as the last investor is converting so much currency that the benefits exceed even the need to “break even” and the home can be sold at a net loss. When that moment is reached the appearance of sustained house price growth ends and the scheme ends moving the scheme somewhere else.

The Probability:

Ross Kay Realty Consultants is not qualified and does not possess the data to allow an honest interpretation of “probability” in this instance.

The Outcome:

Canada's Average Selling Price is so reliant on the sale of Ultra-Luxury and Luxury homes located in Vancouver and Toronto, that even a minor negative shift in sales activity levels in those homes would have grave consequences across the entire nation of homeowners. At Ross Kay Realty Consultants we believe the number of repeat sales where a trade in real estate is between one foreign owner to another is being massively under reported in sales records and is then showing up months later in sales prices being recorded for homes entering the Currency Exchange Ponzi scheme that are first sold and recorded as they leave the hands of their original Canadian owner.

In recent months the Chinese government has added further restrictions to how currency can exit that country and by all accounts sooner than later much of that exodus that is still being allowed on “claims” to acquire residential real estate for individuals ( non-corporate owned) in other countries will be curtailed or virtually eliminated. At the same time, house price gains recorded in the Ultra-Luxury and Luxury class of homes that are already at “legendary” levels while the confidence on the sustainability of further gains continues to drop with each passing month of higher gains being reported.

At Ross Kay Realty Consultants we normally provide a minimum twelve to six month window for our clients to allow them to make decisions ahead of the next turn in the market but because of this research and the situation in Vancouver and Toronto we are dropping our own window of warning down to four months which would be the smallest window since 1989. When our own intelligence drops to such short notice it means more rapid and more violent changes to house price growth are possible and that a higher probability of that taking place exists.

If the “capital tap” in China is “turned off” for any reason, the fallout across Canada will be unfavourable. It is implicit on provincial and federal governments right now to immediately or retroactively modify foreign ownership rules on Canadian residential real estate. At the least a minimum “hold” period of five years should be applied to any Canadian residential home currently owned by a foreign owner, the hold should be retroactive against any homes purchased in Canada in the last five years by its current foreign owner.

Ross is available for media requests.

The Currency Exchange Ponzi Scheme Process:

A investor seeking to remove Chinese Yuan from China and have it converted into a foreign currency purchases a home in Vancouver. The investor once having the currency exchange authorized and completed for the purchase to take place then offers the same opportunity to another investor who is willing to offset any costs the original investor incurred through paying a high enough price for the same home that then allows the previous investor to “break-even”. This pattern is continued over and over again causing the selling price to raise higher and higher at no risk to the investor, while at the same time offering higher and higher amounts of currency to be exchanged on the rising home price being paid.

At no time is the price paid reflective of fundamental value of the real estate being traded but is being established for ulterior purposes that are not related to normal house price growth.

At some point in time the scheme ends as the last investor is converting so much currency that the benefits exceed even the need to “break even” and the home can be sold at a net loss. When that moment is reached the appearance of sustained house price growth ends and the scheme ends moving the scheme somewhere else.

The Probability:

Ross Kay Realty Consultants is not qualified and does not possess the data to allow an honest interpretation of “probability” in this instance.

The Outcome:

Canada's Average Selling Price is so reliant on the sale of Ultra-Luxury and Luxury homes located in Vancouver and Toronto, that even a minor negative shift in sales activity levels in those homes would have grave consequences across the entire nation of homeowners. At Ross Kay Realty Consultants we believe the number of repeat sales where a trade in real estate is between one foreign owner to another is being massively under reported in sales records and is then showing up months later in sales prices being recorded for homes entering the Currency Exchange Ponzi scheme that are first sold and recorded as they leave the hands of their original Canadian owner.

In recent months the Chinese government has added further restrictions to how currency can exit that country and by all accounts sooner than later much of that exodus that is still being allowed on “claims” to acquire residential real estate for individuals ( non-corporate owned) in other countries will be curtailed or virtually eliminated. At the same time, house price gains recorded in the Ultra-Luxury and Luxury class of homes that are already at “legendary” levels while the confidence on the sustainability of further gains continues to drop with each passing month of higher gains being reported.

At Ross Kay Realty Consultants we normally provide a minimum twelve to six month window for our clients to allow them to make decisions ahead of the next turn in the market but because of this research and the situation in Vancouver and Toronto we are dropping our own window of warning down to four months which would be the smallest window since 1989. When our own intelligence drops to such short notice it means more rapid and more violent changes to house price growth are possible and that a higher probability of that taking place exists.

If the “capital tap” in China is “turned off” for any reason, the fallout across Canada will be unfavourable. It is implicit on provincial and federal governments right now to immediately or retroactively modify foreign ownership rules on Canadian residential real estate. At the least a minimum “hold” period of five years should be applied to any Canadian residential home currently owned by a foreign owner, the hold should be retroactive against any homes purchased in Canada in the last five years by its current foreign owner.

Ross is available for media requests.